|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

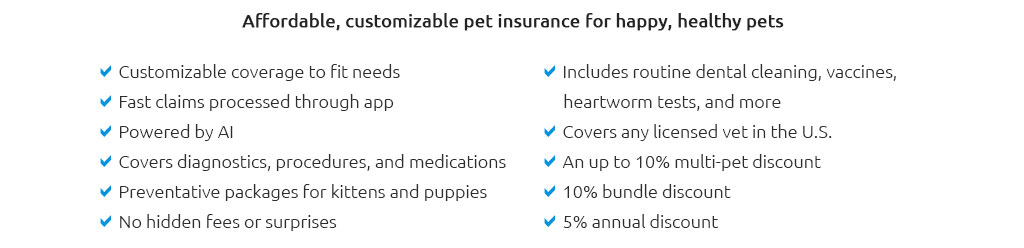

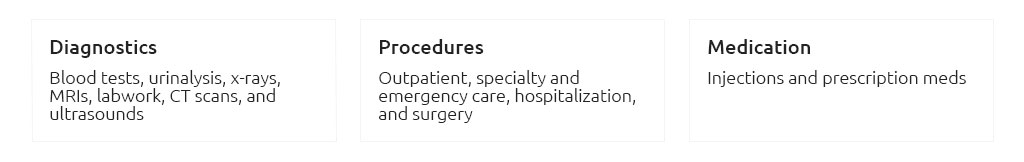

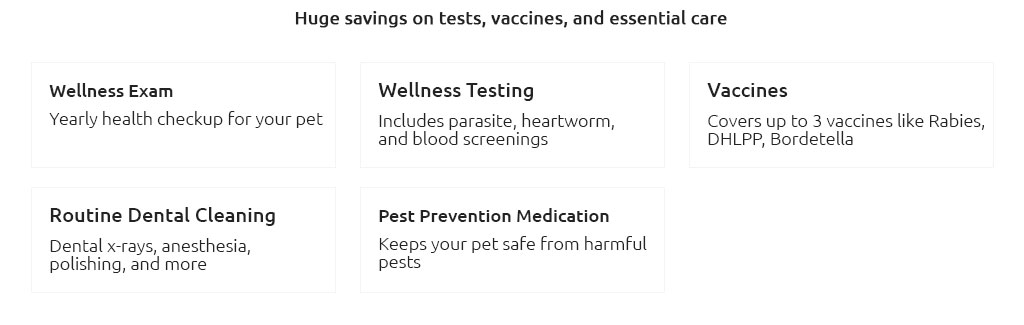

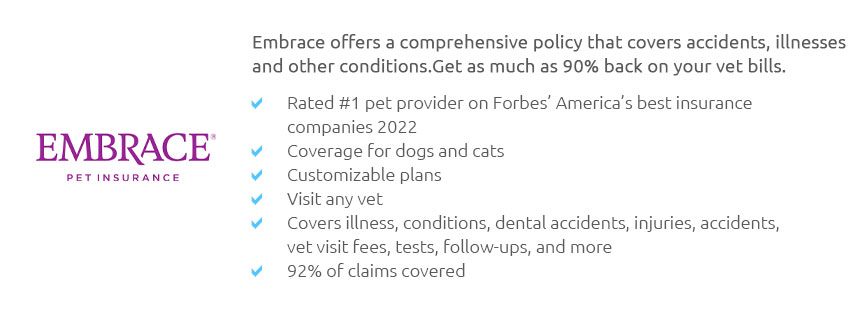

Understanding Pet Insurance: Does It Cover Vet Visits?When considering pet insurance, one of the most common questions pet owners ask is: Does pet insurance cover vet visits? This query is pivotal as veterinary care can be unexpectedly costly, and knowing what is covered can significantly impact your decision-making process. To unravel this, let's delve into the specifics of pet insurance policies, what they typically cover, and where exceptions may lie. Firstly, it's essential to understand that pet insurance functions somewhat differently than human health insurance. While human insurance often covers routine check-ups, pet insurance plans are primarily designed to cover unexpected illnesses and accidents. This means that, in most cases, routine vet visits, wellness exams, and preventive care might not be covered under a standard policy. However, there are exceptions and add-ons available. Many insurance companies offer what are known as wellness plans or riders, which can be added to the basic accident and illness policies. These wellness plans are specifically designed to cover routine care, including annual exams, vaccinations, and even dental cleanings. It's crucial to assess whether such an add-on is financially beneficial for you, depending on your pet's age, breed, and overall health. Some companies provide comprehensive plans that integrate both wellness and illness coverage, offering a more holistic approach. When selecting a pet insurance policy, one should also consider the specifics of deductibles, copayments, and reimbursement levels. These factors can significantly influence how much you pay out-of-pocket during a vet visit. A policy with a higher premium may offer lower deductibles and higher reimbursement rates, which could be advantageous if you anticipate frequent vet visits. It's also worth noting the importance of understanding exclusions. Not all conditions or treatments are covered, and pre-existing conditions typically fall into this category. Carefully reading the policy details and speaking directly with insurance providers can provide clarity on what is and isn't covered. This ensures that you are not caught off guard by unexpected expenses.

In conclusion, while pet insurance may not automatically cover routine vet visits unless you opt for additional wellness coverage, understanding your pet’s specific needs and evaluating different policies can ensure that you make an informed decision. Ultimately, the right pet insurance can provide peace of mind, knowing that you can afford necessary care for your beloved animal companion when they need it most. https://www.petinsurance.com/faq/

All our plans can be used with any licensed veterinarian, anywhere in the worldeven specialists and emergency providers. Get a no-obligation quote. How do ... https://www.progressive.com/answers/pet-insurance-emergency-visits/

Pet insurance can cover emergency vet visits, but the extent of coverage depends on your specific policy terms - Pet owners may pay the emergency vet bill ... https://www.lemonade.com/pet/explained/pet-insurance/

Yes! A Lemonade base policy will cover many of the things that vets use to keep your pup or kitty healthy. That includes blood tests, urinalysis, X- ...

|